Ethereum Price Forecast

Ethereum price today: $3,300

- Ethereum on-chain metrics indicate selling pressure among long-term holders in the past few days.

- Ethereum ETFs recorded a sixth consecutive day of negative flows with $9 million in outflows on Thursday.

- Ethereum could prevail over the $3,400 resistance level and stage a 10% rally to $3,732.

Ethereum (ETH) trades near $3,300 on Friday as on-chain data shows investors’ profit-taking has weighed down on its price. The top altcoin could stage a 10% rally to $3,732 if it retests and overcomes the $3,400 resistance level.

Ethereum investors realize profits following recent price rise

Since Ethereum’s 10% rise on Thursday, Santiment’s data revealed that investors have booked nearly $1 billion in profits — one of the highest in the past three months.

%20[19.04.35,%2022%20Nov,%202024]-638678977436504755.png)

ETH Network Realized Profits/Loss | Santiment

Most of the profit-taking potentially came from long-term holders, as revealed by the spike in ETH’s Age Consumed metric, which measures the number of ETH changing addresses daily relative to the days since they last moved. Spikes in this metric indicate a large number of previously idle tokens moved between addresses.

ETH’s Mean Coin Age metric, which measures the average number of days all ETH stayed in their current addresses, has also been trending downward in the past four days, signaling distribution or selling activity among holders.

%20[19.04.31,%2022%20Nov,%202024]-638678977954885924.png)

ETH Age Consumed & Mean Coin Age | Santiment

A similar trend is visible in a Friday X post by Lookonchain, which revealed that an Ethereum whale sold 73,356 ETH worth $224.42 million over the past two weeks following the recent price increase.

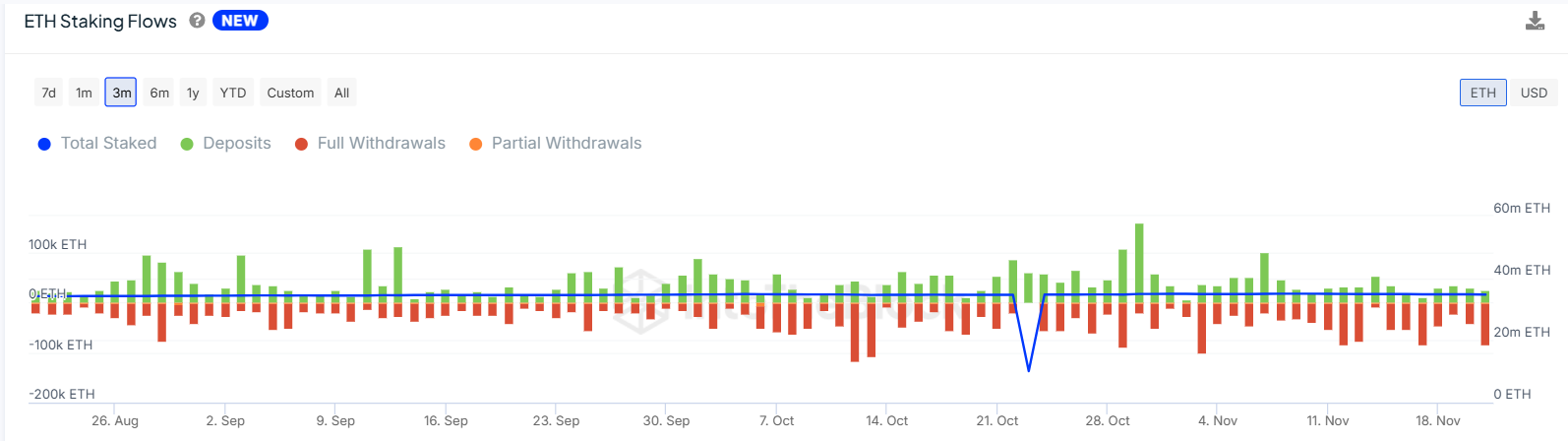

The selling activity is also evident in ETH’s staking flows, which show that withdrawals have consistently outpaced deposits over the past seven days. This has caused a slight downturn in the total number of ETH staked.

ETH Staking Flows | IntoTheBlock

Ethereum is also seeing negative sentiment among institutional investors after ETH ETFs posted outflows of $9 million on Thursday. As a result, the products have stretched their negative flows to six consecutive days of outflows for the first since August.

However, ETH exchange net flows and open interest indicate a slight positive trend. The top altcoin recorded net outflows of over 100K ETH worth ~$320 million in the past three days, per CryptoQuant’s data. Unlike ETF flows, exchange outflows indicate buying pressure.

Ethereum’s open interest also surged to a new all-time high above the $20 billion mark on Thursday, per Coinglass data.

Ethereum Price Forecast: ETH could prevail if it retests key resistance

Ethereum is down 1% following $49.32 million in futures liquidations in the past 24 hours. Liquidated long and short positions accounted for $28.32 million and $21 million, respectively.

ETH has been trading within a key rectangle channel for the past two weeks, with resistance near $3,400 and support close to the $3,000 psychological level. The top altcoin saw a rejection at the rectangle’s resistance for the second time on Thursday and is testing the Exponential Moving Average (EMA) blue line.

ETH/USDT 4-hour chart

A decline below the EMA could send ETH to find support near the $3,000 psychological level. If ETH bounces off this level, it could see increased buying momentum to charge above $3,400. Such a move could see ETH rally nearly 10% toward the resistance level at $3,732.

However, if the $3,000 support fails, ETH could decline toward the $2,817 key level, which was a critical support level for nearly four months — April to July.

The Relative Strength Index (RSI) is above its neutral level and trending downward, indicating weakening bullish momentum.

A daily candlestick close below $2,817 will invalidate the thesis.